This is truly shaping up to be something of a golden age for pet specialty chains.

Despite rising competition from seemingly every direction as players from other retail channels—including the Internet—try to capture a piece of the lucrative pet care market, pet chains have been able to effectively leverage their unique competitive strengths to continue growing year after year. Whether it’s access to brands and products that simply cannot be found in grocery and mass outlets, or the ability to deliver an unmatched level of customer service that cannot be duplicated by web-based retailers, pet specialty chains still have a clear edge in engaging pet owners.

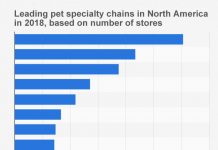

This is illustrated perfectly in the 2016 edition of Pet Business’ Top 25 Retailers list, which ranks pet store chains based on their number of locations in North America. Almost every retailer on the list experienced at least some growth since the beginning of 2014, with some expanding at a rather phenomenal rate. In fact, the Top 25 chains collectively added more than 600 stores during this period, representing a nearly 14-percent increase in just two years.

|

Of course, PetSmart and Petco, with approximately 1,433 stores and 1,292 stores, respectively, remain at No. 1 and No. 2 on the list. But surprisingly, for the first time since Pet Business began tracking the Top 25 Retailers, one of the big-boxes was actually outdone by another competitor when it came to adding locations. |

TOP 25 PET RETAILERS LIST |

|

Pet Valu, a Canada-based chain, has made significant inroads into the U.S. market over the past several years to reach No. 3 on the Top 25 list with 620 stores, including 255 units in the U.S. Its 131-store expansion was second only to PetSmart’s, which added 144 stores. Petco was third in this regard, adding a still-impressive 77 locations. Interestingly, Pet Valu was responsible for not only big additions to the Top 25 list, but also the biggest subtraction. In early 2015, the company acquired the 32-store Jack’s Pets chain based in Dayton, Ohio, which was No. 18 on the last edition of the list. Since then, it has been steadily bringing Jack’s Pets locations under the Pet Valu banner, with about 11 stores completed so far, according to Joe Dent, vice president and U.S. general manager. That effectively pushes the Jack’s Pets retail brand out of the Top 25. A Lot of Plusses “We’ve seen some phenomenal growth over the past couple of years,” says Leonardo. “Our system-wide sales are now approximately $800 million, and this year we are scheduled to open 30 new franchise locations and another 14 corporate stores, which will make it the biggest year we’ve ever had.” California, Colorado, Texas and Florida are all states that have been identified by the chain as being particularly promising for expansion, and PSP’s plans for 2017 are even more aggressive in this regard, with 45 franchise units alone scheduled to open. According to Leonardo, the PSP business model has become increasingly attractive to prospective franchisees for a few reasons, including the company’s willingness to make investments in key areas of operation. For example, PSP recently invested more than $15 million in a new POS system. “It really brings us into the 21st century, when it comes to technology,” he says, noting that the new system includes features such as hand-held checkouts, enhanced loyalty-club management and auto-replenishment. Another recent adjustment to the PSP model that is proving attractive to franchisees relates to the company’s royalty structure. “One of the most interesting things that we’ve done, and which you hardly ever hear of franchises doing, is we’ve lowered our royalty rate to two percent per month for the first 12 months; then it goes up to three percent,” says Leonardo. “Those numbers are unheard of, and I think it’s another thing that is propelling franchisees to look at us. The more money we can put in their pockets, the more units they want to open with us.” Ultimately, says Leonardo, what sells the PSP franchise is the proven track record of its business model. “We continue to have extremely strong sales, and a lot of the credit for that goes to our merchandising team,” he explains. “Not only are they very strategic in how they set the stores, they also work with our vendors to get the best products and the best pricing out there. That is the benefit that we bring to a franchising system—we have the purchasing power of an $800-million brand, so we can help drive a lot of economies of scale through the negotiating process, which results in more profitability for the franchisee.” Expanding the Club According to Gina Ortiz, the chain’s regional manager, and marketing and event coordinator, Pet Club’s explosive growth has been a product of an expanding need among pet owners. “Everybody is really gearing toward feeding their pets the way we feed ourselves, and that has made the Arizona market great for us to expand in,” she says. While much of the chain’s growth has been in the Grand Canyon State, Pet Club has also opened five stores in Houston. This move into a new market obviously brings a host of opportunities for the company, but it is not without complications. “Our biggest challenge outside of Arizona is awareness of the Pet Club brand,” says Ortiz, noting that the chain has been able to meet this challenge with a strong marketing strategy. But adding stores and spreading into a new market aren’t the only ways in which Pet Club has been evolving. Over the years, the company has also added professional grooming services to many of its stores, and in 2015 the company rolled out its private-label food brand—Noland’s Naturals. One more interesting element of the Pet Club chain that bears mentioning is that it actually has two different store models, which are distributed based on the particular needs of a given market. The company operates 25 feed and tack stores, which typically have a larger footprint and are located in more rural areas, where they cater to both working and hobbyist farmers with an appropriate product selection that includes equine fare. The rest of Pet Club’s locations are relatively smaller “pet food” stores, which are more traditional pet shops located in more populous and urban markets. Looking ahead, Ortiz says that while she sees plenty of room to grow the Pet Club chain, she expects that much of the company’s attention will be on its current stores. “We’re going to focus more on our existing business as a main goal, but if an opportunity [to grow] comes up, we will certainly be ready to take advantage,” she says. Concord Takes Flight Transitioning the Cutter’s Mill stores under the Concord banner was a process that took the better part of a year. And while, in hindsight, Mutschler wishes the conversion could have gone quicker, she acknowledges that the slower timeline was necessary. “Their business model was a lot different than ours, so we wanted to give the customers time to adjust to our strategy,” she notes, providing an example. “They were very big on coupons and discounting, while we had a lower price to begin with, and it took some time to get customers to understand that.” One element of the old Cutter’s Mill stores that Mutschler says did not change with the sign over the front door was the familiar faces inside. “All of the staff, including the store managers, have stayed with us,” she says. Concord added two more stores in 2015—in Millsboro, Del., and Salisbury, Md. The company’s second store in Maryland, the new Salisbury location is particularly notable, as it represents an expansion further south than the chain has ever gone and reflects Concord’s desire to grow its presence in the state. |

1. PETSMART Phoenix, AZ petsmart.com Territory: U.S. & Canada Stores: 1,433 (approx.)2. PETCO San Diego, CA petco.com Territory: U.S. Stores: 1,2923. PET VALU Markham, Ont., Canada petvalu.com Territory: Canada & Mid- Atlantic, Northeast & Midwest Stores: 620 (approx.) 4. PET SUPPLIES PLUS 5. GLOBAL PET FOODS 6. PET SUPERMARKET 7. PETSENSE 8. PETLAND 9. PETLAND DISCOUNTS 10. UNLEASHED BY PETCO 11. WOOF GANG BAKERY 12. PET CLUB 13. MONDOU 14. PET FOOD EXPRESS 15. PET PLANET 16. BOSLEY’S BY PET VALU 17. HOLLYWOOD FEED 18. PET DEPOT 19. MUD BAY 20. CHUCK & DON’S PET FOOD 21. KRISER’S 22. CONCORD PET 23. PET PEOPLE 24. PET PROS 25. KAHOOTS PET STORE |

In addition to getting larger, Concord has also continued to refine its approach to pet product retailing, particularly in the area of marketing. “We’re doing a lot more marketing through social media,” says Mutschler. “We’re also trying out different things to generate excitement in the stores, so we’re doing some weekend sales and other promotions that the employees can get behind.”

The goal of these new efforts is to help drive up the stores’ add-on sales—one of the few areas in which Concord has seen a decline in business over the past few years. “With the price of dog food getting so high, getting people to buy something additional can be tough,” she explains. “Luckily we’ve had a lot of support from our vendors, which have been really behind us [with promotions].”

Putting Pets Front & Center

One prominent pet store chain whose growth (or lack thereof), in terms of number of stores in North America, was not necessarily indicative of its overall success was Chillicothe, Ohio-based Petland. While the company did not add any new stores since the last edition of the list, its 117 North American locations still put the Petland franchise within the top 10 (at No. 9) on Pet Business’ Top 25 list. What’s more, according to president Joe Watson, Petland saw significant gains in its existing locations.

“Petland stores across the United States have experienced solid, double-digit comp store sales increases over the past 36 months,” he says. “In fact, 45 percent of our U.S. stores had their best sales month ever in December 2015. It is clear that the American public supports our business model.”

When it comes to the chain’s flat store count in North America, Watson points to the company’s rigorous franchisee selection process and the complexities of securing capital for new start-ups as overriding factors.

“Every pet at Petland is a baby,” he says. “Our birds are babies, our fish are babies, our rabbits are babies, and our puppies are babies. Because of this fact, our business model is very difficult to operate. We are extremely selective in who we award a franchise to, and when you add to that the challenges of obtaining bank financing for new construction, our U.S. footprint has been fairly static. “

While Petland’s North American store count may be stuck in neutral, the company is rather bullish when it comes to expansion in other markets around the world. “Like many other global companies, our international business has seen significant growth,” says Watson. “We will likely end 2016 with an equal number of domestic stores as we have internationally.”

Aside from its global reach, Petland stands out from many of the other chains on the Top 25 list because it is one of the few that actually sells pets. This is an aspect that has proven quite rewarding and formidable at the same time. But according to Watson, it is a function that is essential to the pet industry overall.

“The survival of the pet industry is dependent upon our ability to sell, adopt and breed pets,” he says. “Without pets, the pet industry will not survive.”

In this regard, Watson points out that the pet industry has “a serious sustainability problem.” Pressure from animal rights groups on regulators, he says, is leading to a drastic decline in pet breeding, which will eventually have serious repercussions for all pet product marketers.

“We have seen USDA-licensed dog breeders numbers drop from 5,872 breeders in 2007 to just over 1,500 today,” says Watson. “This is an alarming decline, in dog breeding alone.”

In addition to depressing the supply of well-bred and cared for pets, the efforts of animal rights groups have presented an even more direct challenge to Petland by driving local governments to enact ordinances to prohibit the retail sales of pets, he adds.

Despite these tough challenges, Watson remains confident in the Petland business model’s potential for growth. “We will remain the leader in pet retailing worldwide,” he says. “We are entering our second year of an aggressive five-year growth strategy, which will include the addition of domestic stores. I believe the best days for Petland are ahead of us.”